Advertisements

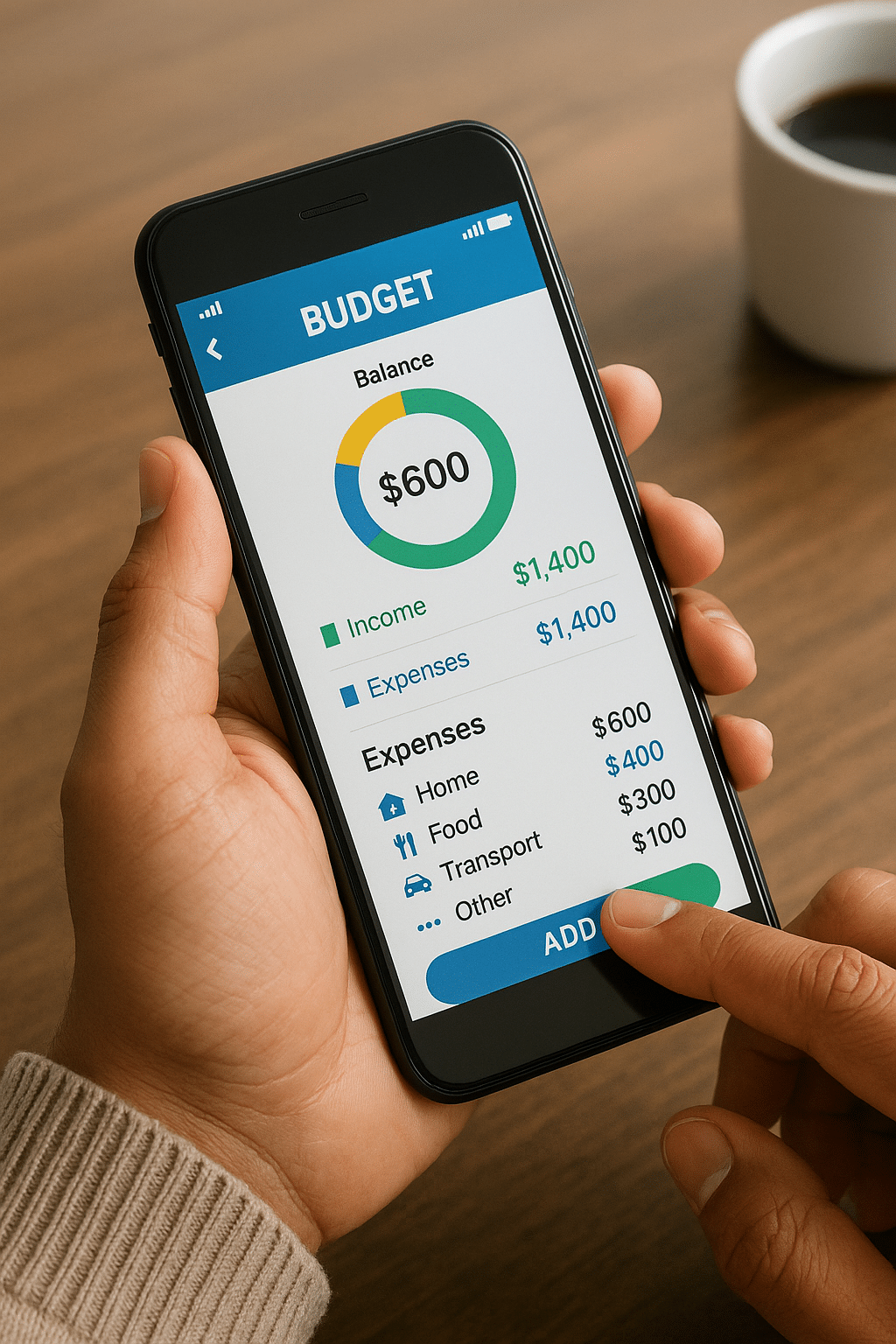

Imagine that, at the end of this month, you know exactly how you spent every peso, every dollar, every cent. And not only that. You also know how much you can save. What expenses you can cut. Where's that silent leak that's keeping you from growing. Now imagine doing all of this from your phone. No spreadsheets. No mental math. And no stress. Apps that transform the way you spend.

Sounds good, right?

Advertisements

Today we're going to talk about that. About how to take control of your financial life. How to stop chasing money and start managing it with intelligence, strategy, and freedom.

And yes, I'm also going to tell you about two apps that really impressed me. Not just because they work. But because they do so in a clear, user-friendly, and surprisingly effective way.

Get ready. Because after reading this, you'll see your personal finances in a different light.

Advertisements

See also

- Apps to combat stress and anxiety.

- Discover the symphony of nature

- Master communication with 3 apps.

- Free up space and optimize your phone!

- Immerse yourself in terror anywhere.

The silent disorder

Most people don't keep track of their expenses. Or they do so only half-heartedly.

Maybe you jot things down. Maybe you check your bank from time to time. But without a real system, everything gets lost.

And so come the busy month-ends. The surprises on the credit card. The "where did it all go?"

It's a repeating cycle. And the worst part is that it makes you feel bad about yourself. As if you're failing all the time.

But it's not your fault. It's just that no one taught us how to do it right. Until now.

Why use an app for your finances?

You need clarity. And you need to really see the numbers.

And you need that not to take more time than you can give.

A good finance app does much more than show you how much you spent.

It gives you vision. And it organizes you. It alerts you. But it guides you.

It allows you to plan, save, invest, pay off debt, and make smart decisions.

Everything from one place. Hassle-free.

And once you try it, you never want to go back to chaos.

Fintonic: all in one place

The first app that surprised me was Fintonic.

From the moment I opened it, I felt like someone had really thought about what I needed.

Fintonic connects to your bank accounts securely and automatically. It groups your expenses by category. It tells you how much you're spending on food, transportation, subscriptions, entertainment, and more.

But it doesn't just show. It also recommends.

Did you pay more on insurance than last month? Fintonic will let you know.

Do you have a duplicate charge? We'll notify you.

And are you going over budget? It sends you an alert before it's too late.

Plus, its interface is clear. No cold numbers. No technical jargon. Everything is easy, human, and accessible.

What I liked most: you can set goals. For example, "save for travel" or "cut down on delivery spending." And the app supports you like a real financial coach.

Spendee: The Art of Seeing Your Finances with Style

The second app that won me over was Spendee.

A perfect blend of design and functionality.

Spendee is ideal if you prefer to enter your expenses manually or if you use more than one currency. You can create different "wallets": one for your cash, another for your card, and another for a specific trip.

Everything separated. Everything organized.

The cool thing is that you can see your expenses in graphs that are actually understandable.

And you can share wallets with your partner, family, or roommates. Perfect for those who manage shared accounts.

Spendee doesn't just organize. It helps you make decisions visually.

See what you're overdoing. What you can adjust. What you can leave out.

And you do it without guilt. With data. With clarity.

You don't need to be an expert to have control

One of the most limiting beliefs is thinking that “finances are complicated.”

And they aren't. We just need the right tools.

These apps are designed for real people.

People who work, who study, who live with their families, who travel, who pay rent, who use cash and cards. People like you.

You don't need to be an accountant or even know anything about economics. You just need the desire to improve.

And when you do, something changes inside. You begin to feel lighter. Freer.

Because you know you're making conscious decisions. And that, believe me, is worth more than any amount of money.

Financial habits you can create starting today

It's not about controlling every coin. It's about living better.

And for that, here are some simple ideas that you can apply with these apps:

- Set a realistic monthly budget and review it weekly.

- Write down your daily expenses for 30 days. It'll change your perspective.

- Delete at least one subscription you don't use.

- Set a savings goal, even if it's small.

- Group your expenses by color or category and observe patterns.

- Compare your current spending with last month's.

- Have a meeting with yourself every Sunday to review your financial week.

These habits, combined, create a system. And that system gives you stability.

Living without financial anxiety is possible

Can you imagine living without fear of payment deadlines?

No stress from unexpected events?

With money set aside for enjoyment, not just survival?

That's not a dream. It's a possibility. And it starts by seeing your numbers as allies, not enemies.

Apps like Fintonic and Spendee make the process even more enjoyable.

And it's not about limiting yourself. It's about making better choices.

Spending with intention. Saving with purpose.

And when that happens, money stops being a problem and starts being a tool.

Apps that transform the way you spend

Conclusion: Your freedom begins with your decisions.

We're here now. And taking control of your finances has never been easier.

You no longer need sheets. Nem formulas. Nem suposições.

Today, with an app on your cell phone, you can transform your financial life.

Fintonic and Spendee not just applications. São guides. Espelhos. Habit mappers.

When you understand how you spend, you understand how you live.

And when you are silent, everything is silent.

Financial freedom comes with a step.

It could be that day. This may be the start of your turn.

Download here:

- Fintonic:

- Spendee: